The Court of Appeals for the Federal Circuit (“CAFC”) recently issued a decision focusing on the doctrine of equitable intervening rights. Specifically, the CAFC affirmed that equitable intervening rights can apply even if a party has already recouped its investment in the infringing technology.

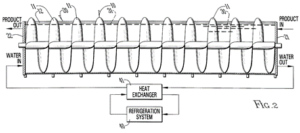

John Bean Technologies Corporation (“John Bean”) is the owner of U.S. Pat. No. 6,397,622 (the “’622 patent”). The ’622 patent covers an auger-type poultry chiller used to help process poultry for human consumption. Morris & Associates, Inc. (“Morris”), John Bean’s competitor, on June 27, 2002, wrote a demand letter to John Bean, expressing its belief that the ’622 patent was invalid and disclosing allegedly invalidating prior art references. Morris received no response and thus, developed and sold chillers that included features in the ’622 patent. Over a decade later, on December 18, 2013, Bean filed an ex parte reexamination of the ’622 patent before the United States Patent Office (the “USPTO”), and ultimately amended two claims and added six new claims. John Bean then sued Morris for infringement. Morris moved for, and the District Court granted, summary judgment, barring the infringement claims based on equitable intervening rights. John Bean appealed.

John Bean Technologies Corporation (“John Bean”) is the owner of U.S. Pat. No. 6,397,622 (the “’622 patent”). The ’622 patent covers an auger-type poultry chiller used to help process poultry for human consumption. Morris & Associates, Inc. (“Morris”), John Bean’s competitor, on June 27, 2002, wrote a demand letter to John Bean, expressing its belief that the ’622 patent was invalid and disclosing allegedly invalidating prior art references. Morris received no response and thus, developed and sold chillers that included features in the ’622 patent. Over a decade later, on December 18, 2013, Bean filed an ex parte reexamination of the ’622 patent before the United States Patent Office (the “USPTO”), and ultimately amended two claims and added six new claims. John Bean then sued Morris for infringement. Morris moved for, and the District Court granted, summary judgment, barring the infringement claims based on equitable intervening rights. John Bean appealed.

The intervening rights doctrine, codified in 35 U.S.C. §252, extends to reexamined patents under 35 U.S.C. §307(b) and limits an alleged infringers pre-existing liability with respect to amended or new claims. If applicable, “an infringer may continue what would otherwise be infringing activity after a reissue or reexamination.” Seattle Box Co. v. Indus. Crating & Packaging, Inc., 756 F.2d 1574, 1579 (Fed. Cir. 1985). The policy behind this doctrine “is that the public has the right to use what is not specifically claimed in the original patent.” Id. (citing Sontag Chain Stores Co. v. Nat’l Nut. Co., 310 U.S. 281, 290 (1940)). The District Court considered six factors in granting summary judgment: (1) whether substantial preparation was made by the infringer before the reissue; (2) whether the infringer continued manufacturing before reissue on advice of counsel; (3) whether there was existing orders or contracts; (4) whether non-infringing goods can be manufactured from the inventory used to manufacture the infringing product and the cost of conversion; (5) whether there is a long period of sales and operations before the patent reissued from which no damages can be assessed; and (6) whether the infringer made profits sufficient to recoup its investment. The court found the factors to weigh in Morris’s favor and likely bad faith by John Bean.

On appeal, John Bean argued that the District Court gave insufficient weight to the fact that Morris recouped its investment and refused to quantify its profits. Specifically, John Beane claimed that Morris had recouped the entirety of its monetary investments prior to the grant of the reissue patent. As such, John Bean argued that Morris’s investment no longer needed “protection” and, thus, there should be no grant of intervening rights. As a matter of first impression, the CAFC determined that 35 U.S.C. §252 does not provide that “monetary investments made and recouped before reissue are the only investments that a court may deem sufficient to protect as an equitable remedy.” The CAFC found that while recoupment is an acceptable factor for consideration, it is not “the sole factor,” nor dispositive, when the court balances the equities. The CAFC emphasized the broad equity powers afforded to the District Court and noted its consideration of six factors in concluding that Morris was entitled to intervening rights. Thus, the CAFC affirmed the District Court’s ruling, finding that it had not abused its discretion.